The ESG compass for Fintech startups is out!

Introducing the ESG Compass: Research Findings Unveiled – An overview of ESG reporting for Fintech startups, tailored to relevance.

In an era where environmental, social, and governance (ESG) factors are gaining increased attention, Fintech startups and investors find themselves faced with the challenge of understanding the relevance of ESG and implementing ESG reporting. As the demand for responsible and sustainable business practices grow, it is crucial for both investors and startups to navigate this complex landscape effectively. To simplify the process, we are proud to announce the creation of the ESG Compass – an easy-to-read overview designed to guide startups and investors in their ESG reporting journey.

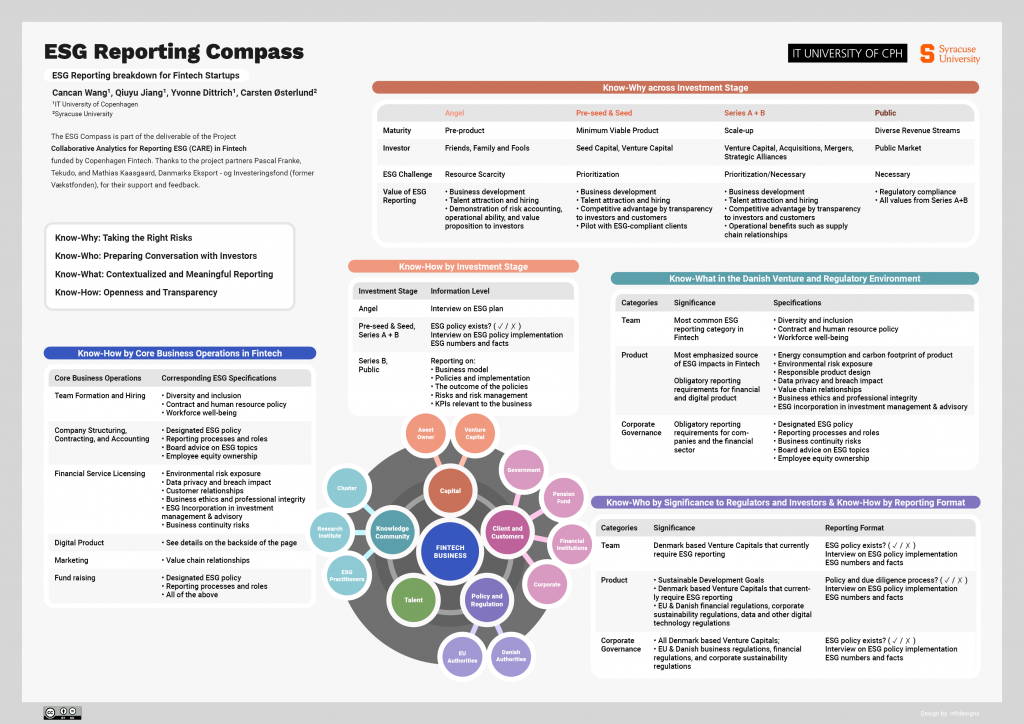

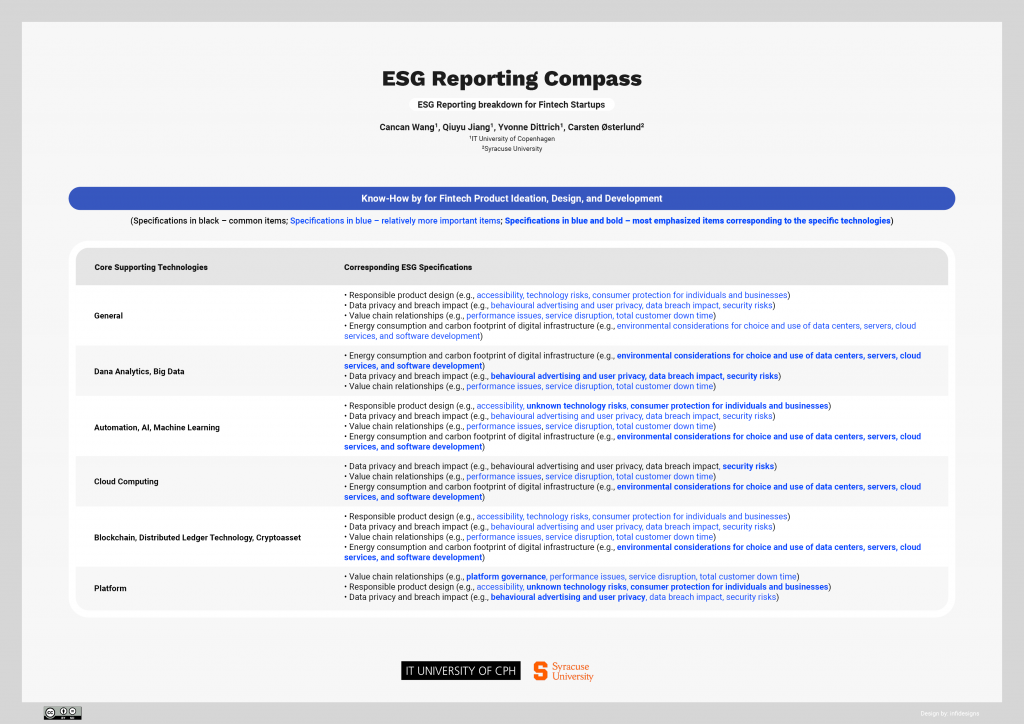

The ESG Compass is divided into four sections, each representing a different type of knowledge that startups and investors should acquire and pay attention to at various investment stages. By focusing on these essential areas, the compass aims to provide a clear understanding of what to report on, the appropriate reporting format, and how these categories relate to the individual core business and overall development of a specific company.

The four sections help make sense of ESG reporting requirements, by breaking them down into ‘Know-Why’ (why should we strive to comply with ESG benchmarks, and which risks should we take on), ‘Know-Who’ (who are the essential stakeholders to know in the ESG landscape), ‘Know-What’ (which ESG categories are relevant to report on for Fintech startups), and ‘Know-How’ (which core business operations are related to which ESG categories?)

The ESG Compass serves as a practical tool, supporting Fintech startups and investors in their efforts to navigate the ESG reporting landscape, build a robust and feasible plan for their ESG journey, and enhance their overall sustainability and long-term value. Investors, armed with a comprehensive understanding of ESG factors, can make informed decisions that align with their values and contribute to a more sustainable future.

If you want to learn more about our empirical findings from the research projects CAREinFintech and IDEAinFintech about ESG reporting for Fintech startups, stay tuned for the final report coming out very soon. You can also read more about the projects here.

We thank Copenhagen Fintech for generously funding our two research projects CAREinFintech and IDEAforFintech. We also thank all our partners for providing valuable insights for the development of the ESG Compass. AT: Mathias Kaasgaard (Denmark’s Export and Investment Fund), Pascal Franke (Tekudo), Camilla Møller Espersen (PreSeed Ventures), Emma Kjellander (PreSeed Ventures), Thomas Mardahl (Rejoose).

0 Responses